- Point of view

Outcome-based commercial models: At the point of accelerated adoption

Commercial models between buyers and providers of transformation and managed services are finally beginning to shift, following years of speculation with limited adoption. Sourcing advisors, buyers, including heads of global business services, and service providers are all moving towards outcome-based commercial models for large transformation projects.

Contracts for large transformation have traditionally focused on the number of full-time employees (FTE), or levels of effort or output, but now commercial agreements are looking to define value against critical business goals, such as revenue growth, working capital, or customer experiences. Indeed, interest in these models is not only picking up, but accelerating in popularity.

As organizations invest in digital-led transformation and leverage an ecosystem of innovative partners to execute their strategies, we expect the adoption of these models to increase at greater speed.

Addressing value, timing, and ownership arbitrage:

In our experience, outcome-based commercial models need to address three types of arbitrage:

- Value arbitrage: Buyers and service providers often define value and where it comes from differently. A buyer can have multiple sources of value, including cost, cash flow, growth, customer satisfaction, and speed, whereas a provider typically has only one source of value: to reduce the cost of delivering its services, sharing the rewards with the buyer, and getting compensated for the outcomes delivered

- Timing arbitrage: For buyers, the benefits and costs realized do not occur at the same time—there is a lag between when the cost is incurred and when the benefits are realized that needs to be understood and accounted for

- Ownership arbitrage: The benefits and costs are accounted for in different budget codes owned by different owners in the buyer’s organization, which creates ownership and incentive complexities

In our experience, there are specific reasons that lead to the above arbitrage; some of the important ones are listed below. To successfully implement the model, these challenges should be addressed between buyers and providers.

Misaligned on value definition

- The provider’s perceptions of which outcomes and metrics are important to the buyer differ from the buyer’s reality

- Softer, non-technical outcomes and metrics, like improved end-customer experiences and risk, are even more difficult to define and achieve alignment on

- There is often an over-emphasis on cost as a source of value, while ignoring the impact on revenue, cycle time, and agility

Limited detail in operating, measurement, and accountability

- Lack of detail to break down value into operating metrics and capability

- Lack of transparent measurement and reporting criteria

Static versus dynamic models

- Commercial models are not dynamic and do not adjust to the changing business landscape or outcomes that are important to the buyer

Commercial model granularity

- The lack of a clear, mathematical model that defines outcomes (with their relative importance), performance targets, operational metrics, and overall payouts

Misalignment of budget owner within the buyer

- Differences in budget ownership for benefits and costs, leading to ownership concerns

Windfall problem—the provider getting paid beyond permissible limits

- The need for proper thresholds and caps in the commercial model to not over-compensate the provider

Innovation and impact objectives

Successful implementation of alternate commercial models should resolve the above challenges, and be based on the target innovation levels and impact objectives for the buyer and provider to achieve (figure 1).

Most buyers and service providers first implement a hybrid commercial model—a combination of effort, output, and outcome-based models. Depending on the success, they then move towards a pure, outcome-based contract. In addition to the impact objectives and degree of innovation outlined in figure 1, there are important factors to consider, such as the flexibility of the buyer and provider to adapt as well as the level of trust that exists between the parties.

Figure 1: Alternate commercial model selection matrix

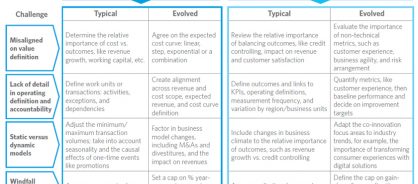

Once the model has been finalized, specific controls and best practices have to be included to address the challenges discussed earlier. Some of these practices and controls are included in table 1.

In addition to the above, buyers and providers should also design and implement a strong governance model that drives ongoing visibility into performance, highlights challenges, and comes up with solutions.

Table 1: Best practices in implementing outcome-based models

Impact

Recent real-life examples show how organizations are reimagining their commercial models by implementing outcome-based models for transformation initiatives, which lead to improved business outcomes, not just reduced costs.

Supply chain management and F&A transformation

A global food manufacturer channels the savings generated by an outcome-based model into an innovation fund for business impact projects that improve customer experiences, working capital, and profits. Projects are agreed to and signed off by a joint innovation council between the buyer and service provider.

F&A and procurement transformation

The contract for a global pharmaceutical firm is based on both the number of transactions and a fixed fee with outcome-based risk and reward. The outcome metrics identified for each process area measure performance, such as close cycle time, past-due payments, and collections to terms.

Supply chain planning and forecasting

A leading electronics manufacturer receives forecasting and planning services based on a fixed price, with penalty and bonus mechanisms for the service provider. Outcomes are based on forecast accuracy, threshold inventory levels, and system up-time, leading to improvements across revenue, customer satisfaction, and inventory levels.

The time is now for outcome-based commercial models

The adoption of outcome-based commercial models is increasing and will accelerate as organizations focus on enterprise goals and invest in digital. For these models to succeed, businesses must address value, timing, and ownership arbitrage by incorporating best practices, controls, and proper governance.

Selecting the most appropriate commercial model depends on the degree of innovation that buyers and providers want to achieve in their relationship, and the business outcomes to improve. The model also needs specific controls and practices to address arbitrage challenges.

By leveraging leading practices and building on lessons learned, organizations can expect easier adoption of these models and to achieve better results.