- Point of view

Data analytics in insurance claims: How to gain better, faster insights using augmented intelligence

As insurers search for growth in the wake of COVID-19, they will be looking for efficiencies that don't impact customer satisfaction. Integrating data analytics into claims operations is one way to achieve this. But to be a strategic differentiator, carriers need to balance claims professionals' judgment with data-supported insights to make better decisions. Adopting an augmented intelligence approach will deliver better insights faster, and in a way that frontline claims teams can execute.

Many insurers have already experimented with new technologies and analytics but have struggled to package the insights into consumable, executable outputs. Some technologies change the platform – or the way the function operates – by introducing workflows to simplify the claims process. This is a substantial investment, both financially and in implementation time, but it doesn't enable carriers to analyze claims patterns and operationalize outcomes. Similarly, some technologies don't provide insights into the overall picture of what's happening in a claim, and so they miss the opportunity to reduce costs.

Insurers are investigating data analytics in insurance claims to help them in three main ways:

- Identify external trends impacting claims outcome

- Process claims faster and at a lower cost

- Complement claims adjusters' intuition and experience

Finding answers to these challenges can improve the customer experience and reduce the cost to operate, all while minimizing indemnity in claims.

Missing insights

Carriers are trying to embed analytics and predictive models in areas of claims operations such as:

- Early exposure recognition and mitigation efforts at first notice of loss (FNOL)

- Damage triage and method of inspection strategy

- Straight-through processing for a claims segment

- Claim complexity and segmentation models

- Early detection flags, such as fraud and subrogation potential

- High-probability models for liability and negligence, injury type and disposition, attorney involvement, and litigation potential

But insurers aren't getting the basics right, and are therefore not seeing the results they expect. They're struggling to leverage structured data from legacy systems or to use unstructured data at all. Output insights aren't being built into their operations. And no matter how great these outputs are, if they're not in a format that the front line can easily engage and execute on, then they can't improve claims outcomes or help claims adjusters do their jobs better. Insurers need to find an approach to analytics that extracts full value from the data they have available to them and then embed insights into claims operations.

Augmented intelligence can deliver the missing value

Adopting an augmented intelligence approach can unlock the true value of claims data analytics to aid the decision-making process and provide insights based on historical trends. By combining human judgment with artificial intelligence (AI)-powered analytics, claims operations can become smarter, faster, and more efficient while delivering a significant return on investment (ROI).

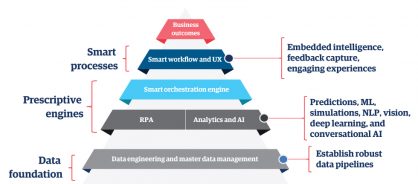

This structured, bottom-up approach builds a strong data foundation and then reconfigures workflows to put the insights to work (figure 1).

Figure 1: An augmented intelligence approach to claims analytics

Data foundation: This leverages a wide range of structured, unstructured, and external data to feed into the prescriptive engines. This can be anything from notes on the claims system and medical documents to repair shop invoices and attorney correspondence.

Prescriptive engines: Business insights from the claims lifecycle are embedded into automation technologies, analytics, and AI. AI and machine learning (ML) analytics can uncover claim characteristics and the best actions for successful outcomes. The algorithms create meaningful flags in the data foundation. For example, if the claimant had a preexisting condition such as diabetes, is this relevant? If it's a bodily injury claim, it's something the claims handler will want to know.

Smart processes: These are designed to create a great customer experience that also complements the business outcome. The analytics insights create easier claims processes and quicker settlements for customers. And improved claims outcomes for insurers include higher rates of straight-through processing, better management of legal expenses, and more accurate identification of fraudulent claims and subrogation opportunities.

Start narrow, then build out

Not starting with the problem that needs to be solved is one of the major reasons the full value of analytics isn't realized. To avoid this, it's best to drill down to a very narrow and specific use case and then expand when it's successfully up and running. Some valuable use cases to get started with include:

- Mitigation efforts

- Liability trends

- Injury patterns

- Attorney and litigation patterns

In addition to being able to manage different types of claims more effectively, using analytics in these areas improves financial outcomes by reducing cycle times. Keeping it specific is more effective and means that the insights delivered to the frontline claims team are actionable and manageable.

Deep dive into data

When the use case has been identified, insurers need to consider the data that's required. Is it reliable? How will it be pulled from legacy systems? They should also scope out:

- How third-party data will be integrated

- Whether the target operating model supports introducing analytics

- How it will plug into workflows

- Whether any processes need fixing

- Which metrics need to be measured

- How to translate insights into improvements

Augmented intelligence in action: claims subrogation management

We worked with one of the leading insurers in the US to identify claims with a high potential for subrogation early in the claims cycle.

Challenge: The carrier's auto insurance unit needed to boost its rates of identifying and allocating claims for subrogation. Referral to subrogation was low, and roughly 40% of the claims referred closed without any recovery, adding to claims expense.

Solution: We built a subrogation analytics engine to improve the end-to-end subrogation management process. This included:

- Analytics models for recovery propensity, estimated recovery potential, and cost of recovery of a claim

- Internal benchmarking analysis to predict the subrogation recovery cycle time

- Analyzing adjuster performance to determine the most effective adjuster for each claim

- A visualization dashboard to monitor performance against KPIs

Impact: We boosted subrogation recoveries by 10% in the first 18 months, cutting the cost of recovery, reducing the time to recovery, and creating capacity for the subrogation adjuster to focus on complex cases during the same period. Text mining extracted key phrases from FNOL notes, such as intersection accident, claimant rear-ended, and hit and run, and provided significant lift to the models.

Augmented intelligence in action: litigation expense management

We worked with a leading US carrier to reduce claims legal expenses.

Challenge: Our client had too many attorneys involved across all types of claims, incurring significant legal expenses. To make it worse, the law firm selected was largely based on the area of jurisdiction of the claim rather than outcomes and expense. Its complex IT and data landscape provided limited insights toward solving the problem.

Solution: We combined external data with the carrier's internal data and deployed a spend analytics framework to identify the key drivers of litigation. This included:

- Aggregating multiple internal and external and structured and unstructured data sources

- Developing homogeneous clusters of legal claims across multiple dimensions for analysis

- Benchmarking law firms and internal attorneys

- Performing key-driver analysis for insights into legal expenses across products and claim segments

Impact: We identified the optimal claim allocation between internal and external attorneys, with external law firms selected based on outcomes and expense.

A framework for analytics success

Analytics has the potential to enhance customer experience while managing overall claim costs. Insurance carriers have been experimenting with it for several years, but the value delivered has been questionable, mainly because it has been treated as a one-off initiative with a lengthy implementation plan that is further delayed because of ongoing technology modernization.

Adopting an augmented intelligence approach provides structure to move from the ideation to implementation of analytics to solve a specific claims challenge. It brings the power of AI, ML, and advanced analytics to claims processes to facilitate data-driven decision-making and enhance the overall customer experience.