- Case study

A large bank enters the auto finance winner's circle

Capturing the checkered flag by transforming credit processes

Who we worked with

One of the subsidiaries of a global retail and business banking brands.

What the company needed

A roadmap for transforming the credit process to a centralized operating model with a shorter time to decision and improved productivity.

How we helped

Redesigned the operating model, enhanced auto credit decision analytics, simplified and optimized credit decision process, and raised dealer awareness.

What the company got

Increased savings, reduction in time to decision, increased volume without additional headcount, and improved dealer experience through enhanced support.

It’s a fact that people love fast cars. But what they don’t love is a slow auto financing process. And that’s exactly what the auto finance division of this bank was struggling with. As a subsidiary of a global retail and business banking brand – with an asset base of $840 billion – the bank is known for its exceptional service, innovation, and expert financial advice. The bank offers a number of vehicle financing options, representing 35% of the market share.

The bank knew that a big part of attracting car buyers is the ability to give them a quick credit decision. But it was bogged down with inefficient credit decision processes that were resulting in lost sales and disgruntled dealers. Genpact had been a part of the bank’s “pit crew” for seven years and was highly experienced in auto finance operations, so the bank asked us for help transform their credit processes.

Challenge

Keeping pace with the competition

The bank was in a dead heat on the auto financing track. With loan rates being relatively equal, the bank had to differentiate itself from the competition some other way – like offering quick credit decisions – in order to attract and retain customers. But the bank just wasn’t keeping pace.

The bank, after taking a critical look at its processes, recognized a number of issues:

- Credit decision making was decentralized at five different locations, with each location doing things a little differently, leading to inefficiency and high management overhead

- The wait time before a new deal was picked from the queue could be as long as three hours, and half of that time was spent on non-value-added activities and multiple application submissions by dealers

- The credit decision rate was low because models weren’t being refreshed and updated regularly, leading to higher underwriting costs

- Multiple back-and-forth dialogs with dealers to get complete, accurate information were a big source of dealer dissatisfaction

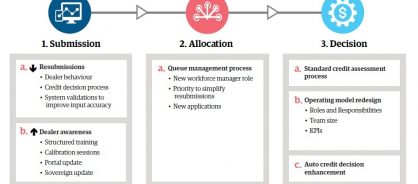

Figure 1: Real life feedback helped us identify the right solution

Solution

Greasing the wheels of the decision-making process

As an integral part of the bank’s pit crew, Genpact was tasked with transforming the credit process and achieving three goals:

- Develop a blueprint for a target operating model for the credit decision team

- Reduce time to decision and standardize the application-to-decision process

- Improve productivity of the credit team

This eight-week transformation project began with a credit process diagnostic. We reviewed the value stream from the time the application was submitted until the time the decision was communicated to dealers. Then we implemented solutions that streamlined every point in the process.

Operating model redesign

- Consolidated credit function with new organization structure and clear division of duties

- Created a new centralized queue management procedure for allocating and managing work

Auto credit decision enhancements

Enhanced credit decision scorecards by adding new parameters and refreshing existing ones to reflect employment, home ownership, age, balloon payment, and more.

Process simplification and optimization

- Identified non-value-added activities and designed standard credit assessment process

- Created operating rhythm and metric measurement frameworks

Dealer awareness

- Designed dealer training and coaching programs for high-volume dealers

- Initiated dealer feedback and net promoter score surveys

- Redesigned dealer portal for ease of use

Figure 2: Solutions were deigned to improve processes across “Submission-Allocation-Decision” value chain

Impact

Pulling ahead of the pack

Once these improvements were identified and implemented, the bank was back in the race and soon pulling ahead to excellence with best-in-class operational processes. Long turnaround times and high operational costs were left in the dust as the bank began winning more business from dealers. As a result, the bank experienced the following benefits:

- Achieved over $7 million in potential savings and approximately 30% reduction in time to decision after changing the operating model

- Improved credit decision by 7%–8% through credit decision analytics

- Reduced non-value-added processes by 40% and touch time by 10%, allowing credit team to absorb additional volume without adding headcount

- Improved dealer experience through enhancement in dealer support

Thanks to Genpact’s experience in customer journey mapping and predictive analytics, the bank moved into the winner’s circle and is now taking a well-deserved victory lap.