- Case study

Generating more prospects and closing commercial loans faster

How a best-in-class roadmap put this commercial lender on the path to winning more business

Who we worked with

A multinational investment bank and financial services company with more than $750 billion in assets.

What the bank needed

- Improve the effectiveness of its sales force in growing the pipeline

- Increase operational efficiency so relationship managers could successfully handle all new prospects

- Deliver a superior customer experience

How we helped

We developed comprehensive solution options to transform the bank's commercial lending function, each of which addressed people, processes, and technology, and had its own cost-benefit impact statement.

What the company got

Targeted solutions expected to deliver:

- 30% more commercial lending prospecting time for relationship managers

- 40% increase in credit process efficiency

- 50% reduction in time to close commercial loans

Challenge

Win more business and improve customer satisfaction

In the commercial lending space, nimble players win. And being nimble means being able to avoid the time-consuming hurdles that relationship managers and client prospects often need to overcome to close a loan.

Our client, a global bank with more than $750 billion in assets, understood this dilemma first hand.

While its existing book of business was highly profitable, inefficiencies across the board hampered its ability to secure new customers. For example, a loan closing typically took much longer than the industry considered to be best-in-class. And less time spent with customers meant customer satisfaction was suffering.

Our existing relationship had earned our client's trust. The bank knew it could count on us to use our industry expertise and mastery of advanced digital technologies to deliver a roadmap that would lead to a commercial lending transformation.

Solution

A variety of technology-led solution options

We evaluated the bank's entire credit process — from prospecting to loan closing — using a five-step methodology. Then, we developed multiple solution options. Our proprietary Commercial Lending Smart Enterprise Process (SEPSM) framework made sure each option addressed metrics that mapped directly to the bank's business objectives and optimized the end-to-end process with analytics and technology.

Figure 1: Genpact’s 5 step assessment methodology

The five steps

Step 1: Define quantifiable metrics

The bank had three distinct goals:

1) Improve the effectiveness of its sales force in growing the pipeline

2) Increase operational efficiency so relationship managers could successfully handle all new prospects

3) Deliver a superior customer experience

We began by translating those goals into four quantifiable metrics:

- Time spent by bankers on prospecting

- Percentage of deals closed – the number of customers taking a loan after being qualified as potential prospects

- Loan closing cycle time

- Cost per loan originated

Step 2: Set baseline for current state

We manually collected data and conducted interviews to measure the current state. Then, we attached realistic targets to each of the four metrics. This helped us to understand the gaps. And for the first time, the bank gained baseline visibility into every stage and subprocess in its commercial lending function.

Step 3: Identify constraints

Next, we pinpointed more than 30 factors across six distinct areas that were keeping the bank from achieving its goals. These areas included inefficient credit process execution, suboptimal underwriting due diligence, partially automated workflows, data duplication, lack of clarity in roles and responsibilities, and process variation. To help prioritize, we ranked each one of the more than 30 factors as high, medium, or low impact.

Step 4: Recommend solutions

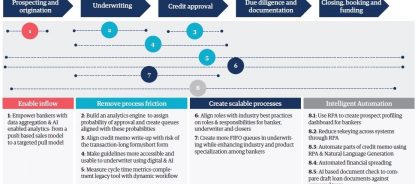

After that, we generated several comprehensive options covering the end-to-end commercial lending process. Each option featured an operating model, process, and intelligent automation components for a best-in-class transformation. Our recommended solutions included automating credit memos using natural language generation, automating financial spreading using our artificial intelligence platform Cora LiveSpread, and robotic process automation for a prospect-profiling dashboard. We also developed a model that showed the bank the quantifiable impact of each recommended solution on the four defined metrics. See figure 3.

Step 5: Establish implementation plan and cost-benefit analysis

Finally, we created a recommended implementation roadmap for each of the solution options. To make it easy to implement, the plan spanned two years and contained a breakdown of high-, medium-, and low-impact components into six-month increments. In addition, we developed a financial impact model that allows the bank to calculate the cost and benefit of each solution, so that it could prioritize which to implement.

Figure 2: Solution summary

Figure 3: Quantifying anticipated benefits and business impact

Impact

Fewer hoops and more prospecting

With our detailed solution options, our client can expect to:

- Increase commercial lending prospecting time for its relationship managers by 30%

- Increase its credit process efficiency by 40%

- Reduce its time to close loans by 50%

Collectively, these will deliver a bottom-line annual impact of more than $20 million. And that's what we call money in the bank.