- Point of view

Streamlining record to report for enhanced agility

Boost your financial closing and reporting for confident decision-making

Organizations are adapting to new ways of working, prioritizing safety and business continuity and building long-term resilience. To respond to immediate challenges and tomorrow's reality, they need accurate reporting to drive the right business decisions.

Controllership teams across industries are assessing the risks and impact of COVID-19 on their businesses' current and future reporting periods. And they're finding ways to maintain smooth accounting and reporting to statutory authorities with all COVID-19-related disclosures.

We've identified three phases that record-to-report (R2R) functions should follow to build agility, reduce cost, and enhance resilience, and deliver faster closing and reporting. But first, we explore the challenges to driving controllership and providing financial planning and analysis teams with the right insights.

Take a copy for yourself

Quality and timeliness of closing

Organizations need to reinvent their finance operating model by integrating digital into their processes to close the books on time and gain quick insights into financial performance in less predictable times. This makes it more critical for finance professionals to perform accounting on a continuous basis rather than waiting for inputs at the end of every month. Every day counts, and each insight matters.

Confidence in numbers

As uncertainty from Coronavirus continues and finance teams manage the operational challenges of keeping processes running and understanding the impact on the business, controllership teams have the added responsibility of delivering accurate financial reporting. R2R teams have to check if the financial information being reported considers the impact of COVID-19.

Balance-sheet reviews to analyze dimensions such as causal relationships, correlation analysis, and policy exceptions identify gaps in financials. Risk-control frameworks deliver robust controls and spot potential control lapses that also help report precise numbers.

Quality of balance-sheet reconciliation

Reconciliation is important to maintain the financial integrity of balance sheets and track open items so they can be resolved in a structured way. Today, organizations have to adopt a risk-based approach to clearing material open items that can misrepresent financial statements. Organizations that have reconciliation tools will be better off than others. For example, policies embedded in the tools should define low, medium, and high-risk reconciliations to drive controllership with optimal effort.

Disclosures and reporting requirements

Companies will be required to make additional disclosures related to the impact of COVID -19 on, for example, business risk, the effect on supply chains, and loss in sales or revenue. With delays in receiving information from the most affected countries, auditors will rely on stress testing to verify that existing controls are working.

New ways of working

As more people work from home, there will need to be greater coordination across finance operations, upstream and downstream teams, and a continuous assessment of the situation's impact on, for example, the company's financial exposure, liquidity, demand and supply, production planning, and monthly spend.

Organizations that have already adopted global R2R delivery models and have mature workflows in place are best placed to deal with remote work, just as those companies that have embraced cloud solutions instead of on-premise technologies are. Any issue in accessing the application systems can create a ripple effect of delays when processing transactions like journal, reconciliation, intercompany accounting, fixed assets, allocations, and reserving. Which means the business has to wait for insights too.

Along with these key considerations, R2R teams have to watch out for areas that could be significantly impacted by COVID-19. R2R functions must focus on:

- Changes in accounting estimates the company was using before COVID-19 – for example, revenue recognition, bad-debt provisions, onerous contracts, and tax and inventory provisions

- Special considerations, including government-relief programs accounting, disclosures of events occurring after the balance sheet date

- Impairment and fair-value assessment require revisiting the business assumptions used in impairment testing – for example, mark-to-market of investments and derivatives, goodwill and intangible impairment, cash-generating units impairment, and fair-value measurement of financial assets

Navigating the organization through uncertain times

The R2R team plays a key role in the business by providing faster, accurate insights in an environment defined by unexpected changes and new priorities. CFOs and business leaders are turning to their controllers to help them address the specific implications of the closing and reporting process.

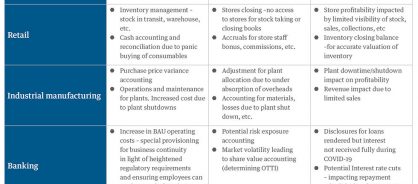

Figure 1 shows industry-specific examples of the impact of COVID-19 on transaction recording, closing, and reporting:

Figure 1: Industry-specific examples of the impact of COVID-19 on transaction recording, closing, and reporting

R2R teams have to refocus their priorities to accelerate closing and reporting and help the organization with informed decision making. We believe the record-to-report organization should focus on three priorities and phases in the next two years: agility, cost to serve, and resilience (figure 2). These initiatives can be measured against speed to value, cost of the initiative, enhanced controllership (EC), and user experience (UX).

Figure 2: Three priorities and phases for R2R

- Agility (0-60 days): In the first 60 days, R2R functions have to become agile and manage uncertainty. With resources already stretched because of general accounting and closing processes, the R2R team will have to find additional capacity to support the organization's increased need, understand the business impact of COVID-19, and deliver reporting that is right first time.

- Cost to serve (60-180 days): When COVID-19 is under control, cost pressures will be immense across support organizations, including R2R. Optimizing the function's cost to serve will be a key priority. Adopting best practices to achieve a continuous close can help R2R teams reduce the peak load and gain access to quick, real-time insights.

- Resilience (180-360 days): Organizations will learn from today's challenges, and investors will reward organizations that can withstand black-swan events. Continuous accounting, process visibility, agile ways of working, and cloud solutions for the financial close will drive this journey. The work-from-home model will be a key requirement for business-continuity planning, which requires companies to redesign their operating model. Implementing a global, integrated operating model will help generate efficiencies that can be reinvested to make the business more resilient in the long run.

Looking ahead

Companies and their R2R teams are being pushed to focus on closing and reporting and provide actionable insights to internal and external stakeholders. But to create value for the organization in the long term, R2R teams must reprioritize their initiatives – focusing on agility, the cost to serve, and resilience.

The journey starts by improving the controllership function's speed to response moves through to enabling continuous accounting and only ends once the business has future-proofed R2R against unforeseen disruption.

Learn more about how Genpact can help with record to report.

This point of view is authored by Rajesh Sanghvi, VP, R2R Service Line, and Garima Kapoor, AVP R2R F&A Service Line at Genpact.