- Point of view

Transforming dispute resolution with AI

Automation and AI can help banks and fintechs transform the dispute resolution process and customer experience

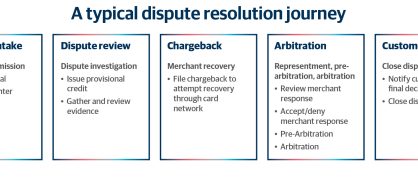

With ecommerce and digital transactions becoming mainstream, credit and debit card fraud are on the rise. This has led to a surge in the volume of disputes for financial institutions (FIs) to investigate and process, in turn resulting in higher operational costs, higher losses, and longer dispute resolution times for the customer – up to 120 days to process a single dispute, a significant increase from the industry best practice of 30 days in the past (see Figure 1 for the typical life cycle of a dispute). Inefficient processes and legacy technology compound the problem, leading to frustrated customers and overworked agents.

It doesn't have to be this way.

Automation and AI can help FIs take the routine tasks in dispute resolution off agents' plates, freeing them up to focus on work where they add the most value – fraud investigation. The result: up to 50% lower costs, increased customer satisfaction, and more engaged employees.

Figure 1: A typical dispute resolution journey

The imperative to transform dispute management

Imagine you, a customer of a bank, are on your banking app and notice that several unauthorized transactions have hit your bank account through your debit card. As a result, hundreds of dollars have been deducted, and your account has a negative balance. You are deeply upset that someone accessed your account and are worried because you have important payments due soon.

What usually happens next?

Scenario 1: The unhappy customer journey

You call your bank, and after waiting on hold for more than 20 minutes, the call center agent reviews the transactions you have flagged.

They open a dispute on your behalf and tell you that it could take up to 120 days to resolve the dispute and that a provisional credit will be issued to you within 10 days. You receive the provisional credit but have no other communication from your bank as you anxiously wait for the 120 days to pass.

During that time, you call your bank to inquire about the status of your dispute, only to be put on hold again for several minutes before being told that it's in progress. You're worried that they may claw back the provisional credit any day and leave you financially vulnerable again. You don't feel your funds are safe with your bank and are wondering if you should move to another FI.

Bad customer experiences like this one can have a devastating impact on an FI's bottom line. Not only does the company risk losing valued customers and creating a negative buzz on social media, but it also exposes itself to increased scrutiny and potential penalties from regulators.

Dispute management challenges

A storm is brewing: Increasing dispute volumes are adding additional head count at FIs, resulting in increased operational costs and higher call wait and dispute resolution times. At the same time, consumer protection laws that increasingly require FIs to reimburse customers are ratcheting up global net losses. A lack of experienced and high-performing talent in fraud and dispute resolution is adding to the challenge.

FIs' attempts to remedy the situation are constrained by legacy technology and inefficient manual processes that can no longer keep up with today's burgeoning dispute volumes:

- Many FIs still don't have a digital portal to submit disputes; they require customers to call, walk into a branch, mail, or fax in disputes, which is at odds with customer expectations for a fully digital experience. And in the absence of a transparent digital system, customers often have a limited view of the status of their dispute. As a result, they end up calling their FIs repeatedly, inflating call volume and adding to customer frustration.

- In the back office, agents are often assigned cases manually, leading to disputes being handled on a first-in-first-out basis rather than a risk-based approach that considers chargeback eligibility timelines, the dollar value of a dispute, and so on. This can result in FIs missing critical service levels (for example, regulatory timelines) and increased losses.

- At many FIs, there's no integrated system where agents can look up all the information related to decisioning a dispute. Instead, they must access multiple systems to gather evidence, leading to higher handle times.

- Additionally, the absence of an easy way for customers to upload required documents can lead to delays further down the process when agents realize they need more information to process a case.

- Decisions about disputes are often subjective, creating an inconsistent experience for the customer as well as reputational risk for the FI, as customers often turn to social media to vent their frustrations.

The compounded impact of these inefficiencies is leading to higher average handling times (AHTs) and turnaround times (TATs), increasing losses and breaches in regulatory timelines. It's clear that the dispute resolution process needs to be reimagined end to end.

Transforming chaos into order: Building a digitally advanced dispute management operation

Do you remember your experience submitting a dispute for transactions that left you with a negative balance with your bank? Here's what it can look like after your bank has implemented an automated, unified, AI-led ecosystem.

Scenario 2: The best-in-class transformed customer journey

Your banking app allows you to tap on the relevant transactions and submit a dispute digitally. You are asked to confirm your preferred communication method as your bank processes this dispute (in-app notifications, email, or SMS). You choose SMS. You receive a text with a dispute reference number informing you the dispute has been opened. You are asked if you have any financial hardship as a result of this situation. After tapping "yes," you are connected to a call center agent immediately.

The call center agent seems to have the details of why you are requesting to speak to them and is empathetic to your situation. They ask if you need access to emergency funds to meet your immediate financial obligations (for example, mortgage payments, groceries, and so on). You feel they believe that you have been a victim of fraud. A provisional credit is provided to you the next day. While waiting for the final resolution, you receive SMS messages throughout the process, and the dispute is resolved within 30 days. You feel your money is safe with your bank and that they are experienced in handling fraud. You feel respected, and your sense of loyalty to your bank has increased substantially.

How do we go from scenario 1, the unhappy customer journey, to scenario 2, the best-in-class transformed customer journey?

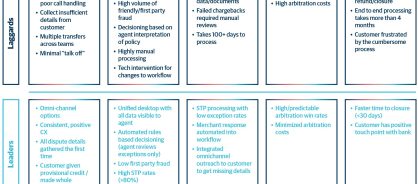

Harnessing AI-led solutions can help FIs deliver exceptional employee and customer experiences while maintaining high-quality operations and move FIs' dispute management up the digital maturity curve from laggards to leaders (see Figure 2).

Figure 2: The dispute management digital maturity journey

Three essential steps for enterprises to begin their dispute transformation journey

How can enterprises make the dispute management process smarter and more efficient? Here are three steps to consider:

- Eliminate data silos: For automation and AI to work, FIs will first need to create a foundational layer of connected systems across its technology ecosystem. They need to ensure all relevant data is integrated, allowing for the creation of a unified agent desktop with a 360-degree view of the customer and the transaction

- Bring in the right technology initiatives and partners: To successfully transform dispute management, FIs will need to consider tactics that will ease the automation process. For example, some leading card networks make changes to their rules twice a year. Establishing backend integrations with these networks will help FIs keep up, making the gathering of transaction information more seamless, reliable, and automatic and increasing straight-through processing (STP) rates. It will also help keep the dispute intake questionnaire updated

- Choose the right ecosystem partner: To keep up with the constantly evolving fraud and disputes landscape, FIs need a strategic partner who brings a combination of world-class technical expertise, success in using the latest technology innovations like AI, and demonstrated dispute transformation experience to deliver the process outcomes FIs need to remain competitive

Once these three foundational steps are in place, automation and AI can:

- Simplify early stages of dispute resolution: By enabling digitized dispute intake and document upload, FIs can reduce both call center volumes and customer frustration. Also, many potential disputes can be nipped in the bud simply by providing enriched details about transactions to the customer in real time to jog their memory about the transaction they are reviewing. Automating information retrieval at this stage can prevent an inquiry from escalating into a dispute. In cases where a dispute has been submitted, providing automated proactive status updates to customers through a channel of their choice can reduce call volume and improve the customer experience

- Help agents investigate disputes: With fraud becoming increasingly complex and sophisticated, AI-based risk scoring of disputes for probability of fraud can help in the investigation process, enabling clear audit trails and consistency of decisioning across agents. Also, automated inventory management can reduce net losses by prioritizing high-risk disputes close to the end of the chargeback eligibility window

- Streamline chargeback recovery: FIs can automate manual chargeback recovery efforts and related document uploads by integrating with card networks, while intelligent workflows automatically check for merchant responses and move disputes to the front of the agent's queue as soon as they receive a response

- Use generative AI to provide first drafts of documentation: FIs can deploy generative AI to create case notes at various stages of the dispute (for example, at intake, investigation, chargeback, and final decisioning). Generative AI can also summarize merchant responses for the agent

- Facilitate continuous process improvement: Process transformation is not a fix-it-and-forget-it effort. Using AI and data analytics to constantly evaluate and fine-tune processes can help FIs gain visibility into what's working and what's not. AI can also help in identifying fraud trends and provide insights to the upstream fraud strategy team for model updates

The bottom line: dispute management need not be a painful process for FIs or their customers. The right tech-led strategy can help FIs elevate agent and customer experiences as well as strengthen their brand.

Authors:

SHIVANI THAKUR, GLOBAL FRAUD AND FINANCIAL CRIME ADVISORY LEADER, GENPACT

NUNO LOPES, OFFERINGS AND SOLUTIONING LEADER FOR SERVICENOW AND AZURE ORCHESTRATION, GENPACT